| Market Snapshot S&P 500 Futures 5,654.5 +0.51% Nasdaq 100 Futures 19,984 +0.54% US 10-Year Treasury Yield 4.332% +0.037 Bitcoin 96,901.56 +2 |

| |

| | Markets Daily is now exclusively for Bloomberg.com subscribers. Your access will expire on May 10. If you’d like to continue receiving this newsletter, and gain unlimited digital access to all of Bloomberg.com, we invite you to subscribe now at the special rate of $149 for your first year (usually $299). Already a paying subscriber or BBA user? Make sure you’re signed up to Markets Daily with the same email address associated with your account. | | | | | | |

| Markets Snapshot | | | | Market data as of 04:24 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

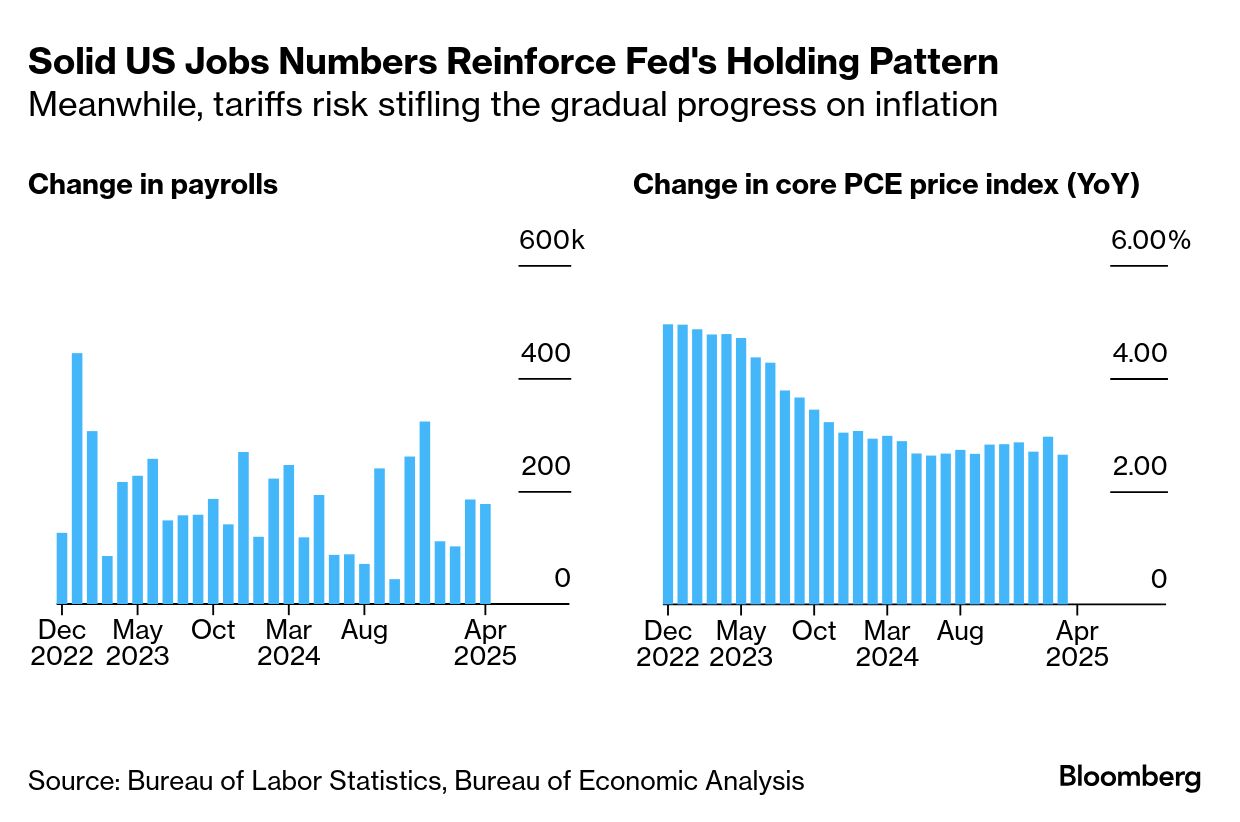

- The Federal Reserve is expected to leave interest rates unchanged — a move likely to frustrate the president. Officials have stressed recently that while uncertainty is unusually high, monetary policy is still in a good place to balance their goals of fostering maximum employment and stable prices.

- Novo Nordisk jumps 6% in premarket trading on expectations that competition for its blockbuster obesity shot Wegovy will subside. Meanwhile, WeightWatchers filed for bankruptcy.

- Stock futures rose and the dollar snapped three days of declines as China and the US prepared to hold their first confirmed trade talks since President Donald Trump unleashed his global tariff war.

- Beijing ramped up efforts to help its economy by cutting its policy rate and lowering the amount of cash lenders must keep in reserve. The People’s Bank of China also expanded its gold reserves for a sixth straight month in April.

- Walt Disney, Uber and Barrick Gold report earnings before the opening bell. Arm Holdings, Occidental Petroleum, Carvana and Flutter are slated for the afternoon.

| |

| |

| It's decision day at the Fed and all eyes are on what it will mean for stock and bond markets.

With the Fed widely expected to hold its benchmark rate steady at 4.25%-4.50%, traders will be pouring over Jerome Powell’s comments for clues on whether President Donald Trump’s policies are prompting any change in the outlook for further rate cuts.

Expectations for lower rates have been faded as of late because of the strong US economy, particularly the last jobs report. Money markets currently price three quarter-point reductions this year, one less than at the start of April.

“The meeting will likely shape expectations more than usual as it is the first decision after the reciprocal tariff announcement,” said Erik Liem, a rates strategist at Commerzbank. “Verbal guidance will be key, as markets have postponed expectations” for monetary easing, he said.  But with economic growth expected to slow and US tariffs still in the cards and earnings season still underway, there are a lot of wildcards at play. In equities, options markets expect a one-day move of 1.1% for the S&P 500 Index after the meeting, according to data from Goldman Sachs. “Hawkish surprises could lead to a temporary decline in cyclical assets,” said Florian Ielpo, head of macro research at Lombard Odier. “A dovish surprise looks extremely unlikely.”

Short-term Treasury yields are vulnerable given that the Fed in March had forecast two rate reductions this year, according to Kevin Flanagan, head of fixed income strategy at Wisdom Tree.

“Unless something bad happens between now and June, it means the Fed doesn’t need to go,” he said. —Michael Msika, Jan-Patrick Barnert, Greg Ritchie and Edward Bolingbroke | |

| |

-

Super Micro Computer shares slide 4.8% in premarket trading after the beleaguered chipmaker gave a sales forecast that fell short of estimates. -

Advanced Micro Devices rises 2.2% after a broadly upbeat outlook. -

Marvell Technology falls 3.5%. The chipmaker cut the high end of its revenue forecast and postponed an investor day event. -

Upstart slumps 15%. The company, which operates an AI lending platform, gave a disappointing outlook. —Subrat Patnaik | |

| |

| |

| US companies are planning to buy back their own shares at a historic clip, opting to return cash to shareholders and provide some support for their stock price in a time of great uncertainty. The value of announced buybacks in the US reached $233.8 billion in April, the second highest monthly tally in records going back to 1984, according to data compiled by Birinyi Associates. Data from Deutsche Bank shows a similar trend, revealing a historic surge in repurchase announcements that are running at more than $500 billion over the past three months. Corporate heavyweights, such as Apple, Visa, Wells Fargo, Delta Air Lines and 3M all announced plans to repurchase their shares during the ongoing first-quarter earnings season. Birinyi’s data showed that the level of planned buybacks last month was only surpassed in April 2022, when it stood at $242.7 billion. “This is an immense amount of dry powder,” that should help support the stock market, said Brian Reynolds, chief market strategist at Reynolds Strategy LLC. Still, buybacks can often send a mixed signal to investors. While leadership’s willingness to invest money in their own shares can be seen as a sign of confidence, it can also suggest they’re holding off on capital investments due to a lack of certainty about the future. —Esha Dey | |

Word from Wall Street | | The market has “seemingly been lulled into a false sense of security by the relative calmness on the tariff front last week, while ignoring continued elevated economic and political uncertainty, and forgetting that there is no ‘Fed put’ to ride to the rescue just yet.” | | Michael Brown Senior research strategist at Pepperstone Group Ltd. | | Brown says he's happy to stick with his rally-selling strategy for the time being. | | |

One number to start your day | | | |

| |

| |

| |