| | Iran fires missiles at a US base in Qatar in a largely symbolic retaliation, oil prices drop, and th͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Iran’s symbolic retaliation

- Oil falls on Iran response

- Lessened tariff impacts

- Chinese IPOs turn to HK

- A new wave of populism

- New York’s new nuclear plant

- China’s record solar power

- US faces extreme heat

- New anti-obesity pill

- Most powerful digicam

What empty aquariums demonstrate about life and memory. |

|

Iran retaliates in symbolic Qatar attack |

Majid Asgaripour/WANA via Reuters Majid Asgaripour/WANA via ReutersIran fired missiles at a US military base in Qatar on Monday in retaliation for American strikes on its nuclear facilities, but Tehran’s attack was largely seen as symbolic — and possibly de-escalatory. Iran gave Qatar advance notice of the incoming missiles, all but one of which were intercepted, resulting in no casualties or damage at Al Udeid Air Base. “The calibrated and telegraphed response,” one analyst said, signaled Iran may be looking for an off-ramp to the conflict, and that this could be the extent of its retaliation. US President Donald Trump thanked Iran for the “early notice” and called for an end to hostilities. Israel has indicated it could cease its military campaign against Iran in the coming days. |

|

Oil prices fall after Iran strikes |

Eli Hartman/Reuters Eli Hartman/ReutersUS stocks rose and oil prices fell Monday as Iran’s restrained response to Washington’s attack suggested that widespread economic disruption is unlikely. Traders had feared the conflict could balloon and disrupt crude shipments in the region, with oil prices rising since Israel began attacking Iran. But investors seem optimistic that Tehran’s largely symbolic strikes on a US military base in Qatar signal a de-escalation, The New York Times reported. “Only in 2025: Energy markets are relieved that the world’s ninth-largest oil producer fired ballistic missiles at the world’s second-largest exporter of liquefied natural gas,” The Economist’s Middle East correspondent wrote. |

|

Economists downscale tariff fears |

Go Nakamura/Reuters Go Nakamura/ReutersWall Street economists are walking back their most drastic predictions for tariffs’ hit to the US economy. “Has Trump outsmarted everyone on tariffs?” Apollo’s chief economist asked this weekend, speculating that the 90-day pause on tariffs could turn into a one-year moratorium that pushes other countries to reduce their own trade barriers and domestic subsidies. “This would seem like a victory for the world and yet would produce $400 billion of annual revenue for US taxpayers,” he wrote. Goldman Sachs, meanwhile, raised its estimates for US economic growth and reduced its odds of a recession, though it warned that hard data is catching up with gloomy sentiment and declared it “too early to sound the all-clear on tariff-driven price hikes.” |

|

Chinese firms delist from US exchanges |

Edwards M Henry Hoos/Wikimedia Commons. CC BY-SA 4.0 Edwards M Henry Hoos/Wikimedia Commons. CC BY-SA 4.0China’s biggest public companies are falling out of love with Wall Street, and rekindling their affair with Hong Kong. While a US stock market listing once marked the pinnacle of success for a Chinese firm, the New York Stock Exchange hasn’t hosted a new Chinese listing since May 2024, The Wall Street Journal reported, as economic tensions between the superpowers and stricter regulations weighed on the private sector. More than 80 Chinese firms have delisted from US exchanges in the last five years. Many mainland firms are instead listing in Hong Kong, which is poised to once again become the top destination for IPOs, ending a five-year cold streak despite a drop in foreign investment, Nikkei Asia wrote. |

|

Global lessons in NYC mayor’s race |

Yuki Iwamura/Pool via Reuters Yuki Iwamura/Pool via ReutersThe popularity of a democratic socialist candidate in the New York City mayor’s race may signal a coming surge of left-wing populism. New polling shows Zohran Mamdani, a 33-year-old state lawmaker, locked in a tight contest with former Gov. Andrew Cuomo ahead of Tuesday’s Democratic primary. The ascendance of Mamdani — whose economic platform includes free bus services and a rent freeze — could offer lessons to a Western left reeling from the rise of far-right actors, a Guardian columnist argued. The second wave of populism following US President Donald Trump’s anti-establishment agenda, Eurasia Group’s Ian Bremmer noted, is “coming from the left,” especially educated and progressive white-collar workers whose jobs, along with their children’s futures, are threatened by artificial intelligence. |

|

NY to build new nuclear plant |

Indian Point Nuclear Power Plant, closed in 2021. Tony Fischer/Wikimedia Commons. CC BY 2.0 Indian Point Nuclear Power Plant, closed in 2021. Tony Fischer/Wikimedia Commons. CC BY 2.0New York will build a nuclear plant to power up to 1 million homes, Gov. Kathy Hochul said Monday, in a reversal of the state’s posture toward the sector. The plant will be the country’s first new facility of its kind built in more than 15 years. The announcement comes four years after the state closed a nuclear power station following pressure from then-Gov. Andrew Cuomo over its proximity to residents. New York’s embrace follows other states as well as companies who are turning to nuclear to meet soaring electricity demand, as President Donald Trump aims to boost the industry and overhaul regulation with an eye to helping US tech giants power artificial intelligence data centers. |

|

China hits solar capacity record |

China Daily via Reuters China Daily via ReutersChina shattered its own record for solar installations for a single month, adding 93 gigawatts of capacity in May. That’s more than any other nation managed in the entirety of 2024, as well as China’s December record of 71 gigawatts. The rush was ahead of a new government policy removing price protections for solar projects, which had all but guaranteed profits for new outfits when they come online. June figures are expected to be much lower, OilPrice.com reported, and paradoxically the high May figures may presage bad news for solar manufacturers, already struggling with price wars and overcapacity. China’s huge outlay on solar is causing large bottlenecks in its energy grid, which is unable to meet the new demand. |

|

With so many financial newsletters competing for attention, it’s hard to find one that makes sense of the market. That’s why over 1 million savvy readers trust The Daily Upside for their daily dose of finance, economics, and investing insights. Created by Wall Street insiders, each issue delivers clear, actionable analysis — straight to your inbox. Subscribe for free today. |

|

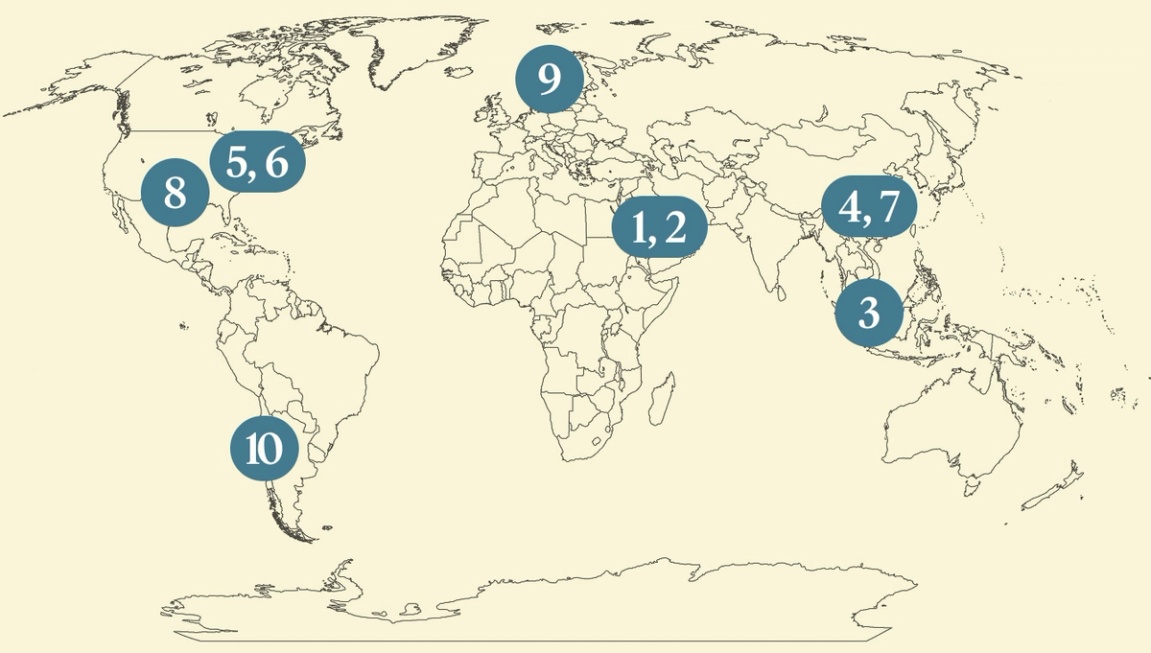

Extreme US heat hits soccer tourney |

Extreme heat in the US is rankling soccer players and fans during the opening matches of the Club World Cup this week. Temperatures could reach 100°F (37°C) in several host cities for the tournament, which features some of the world’s most popular teams. Clubs are increasingly concerned, The Athletic reported, especially since many of the games start in the middle of the day. The sport’s governing body FIFA is under heightened scrutiny, with the tournament seen as a warmup for the men’s World Cup next year in North America. The weather, along with high ticket prices and absent stars, has made the Club World Cup something of a dud, ESPN wrote. |

|

Pill may be as effective as Ozempic |

Hollie Adams/Brendan McDermid/Reuters Hollie Adams/Brendan McDermid/ReutersA new anti-obesity pill appears to be as effective as Ozempic in reducing weight, a trial suggested. GLP-1 weight loss drugs are enormously popular: Semaglutide, better known as Ozempic or Wegovy, is the second-biggest selling drug in the world, making its manufacturer Europe’s most valuable firm. But they require injecting, which makes them inconvenient and unpleasant for some patients; an oral form of semaglutide is available but less effective. Eli Lilly, which makes Ozempic’s key rival Zepbound, is developing an ingestible drug, orforglipron. Phase III trial data found that patients lost on average 7.9% of their body weight in the trial period, comparable to existing drugs, and it was also effective in lowering blood sugar in diabetics. |

|

|