| | In this edition, an interview with Admiral James Stavridis, former Supreme Allied Commander of NATO,͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- The dog that didn’t bark

- Wall St.’s econ bears retreat

- NYC race spooks elites

- Invest in Iran?

- Stablecoins ≠ money: BIS

A 1,000-mile conga line at 30,000 feet |

|

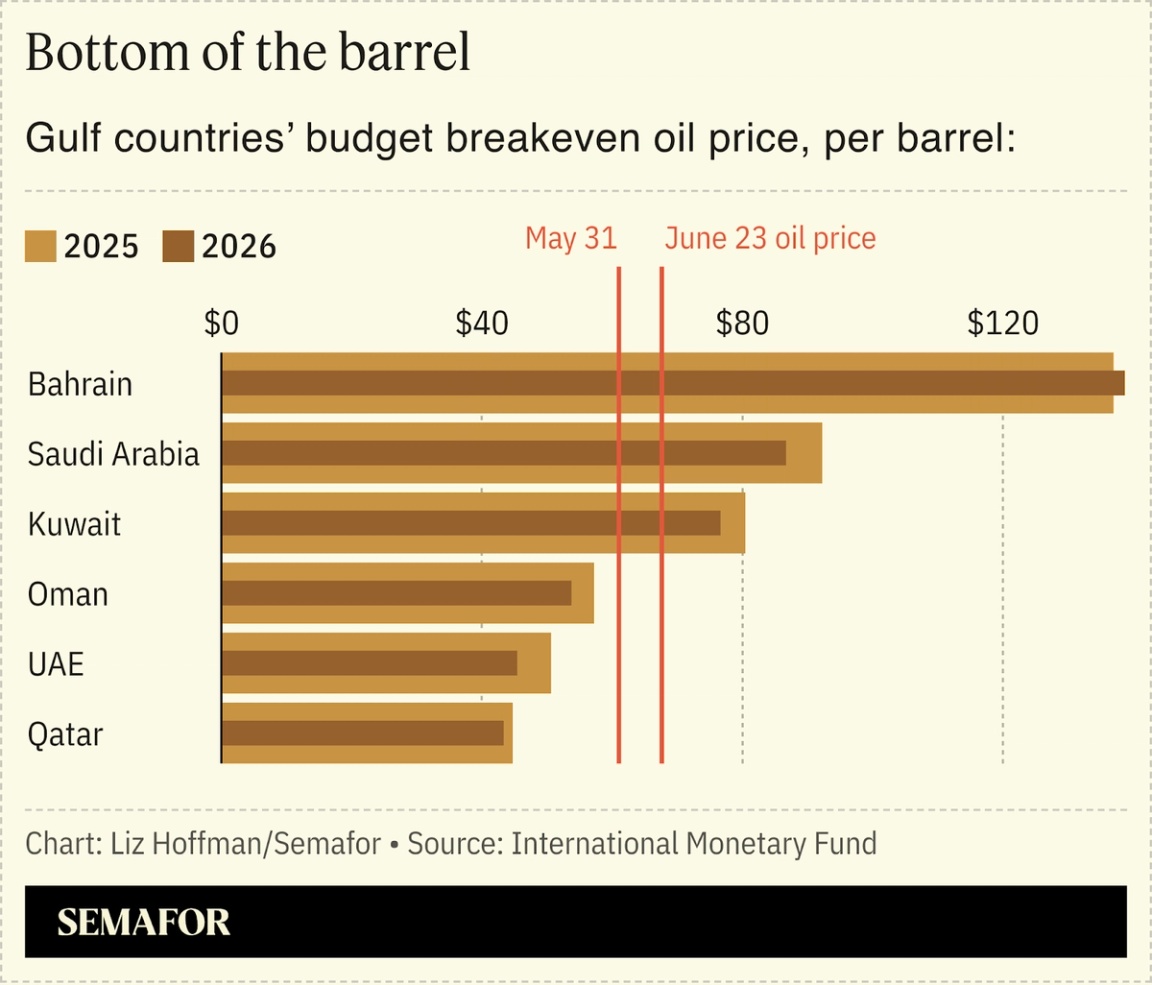

Over the past five years, Gulf nations have recast themselves as modernizing destinations for Western capital, which came by the billions. Then missiles started flying. A few months ago, the big quality-of-life question hanging over the region was when Saudi Arabia’s hotels would start serving alcohol to tourists. Now a worst-case scenario is radiation contaminating the Gulf’s only water source. Safety concerns could send the region’s expats, many of them recently sent from Wall Street, back home. European energy companies including BP are already evacuating foreign staff from Iraq’s oilfields, and wider recalls would be a blow to the region’s burgeoning economy and to the Western firms that have rushed in seeking fortunes. “So far, the smart money is still in the market, but the owners of the wealth may be moving themselves, and their families, somewhere safer,” my colleague Mohammed Sergie noted this week, writing about the eerie calm in Dubai and the lame excuses locals gave to avoid acknowledging the obvious. Gulf governments aren’t as rich or as liquid as their gilded palaces and generous social programs suggest. With oil prices retreating and expected to stay below the breakeven price for many Middle Eastern countries, they rely on global investors to finance their expensive economic transitions. Saudi Arabia, which has been borrowing from global bond investors for months, this week said it would start issuing ultra-short-term debt, called commercial paper. Oman just instituted the region’s first income tax. Kuwait is looking to sell $6 billion in bonds, its first issuance since 2017. With China hopes dimming and European countries turning inward, Wall Street needs the Gulf. But the Gulf needs Wall Street, too. In today’s edition: An interview with Admiral James Stavridis, former Supreme Allied Commander of NATO and now a vice chair at Carlyle, on what he doesn’t see (an expat exodus) and what he does see (Iran as the next investment hotspot?!) |

|

Oil prices fell to their lowest point on Tuesday since Israel and Iran began trading missile attacks, as both countries agreed to a tenuous ceasefire. Analysts expect oil prices to fall back to the low $60s. Ever since the Arab oil embargoes of the 1970s, a full-blown war across the Middle East has been the oil market’s nightmare scenario. Yet over the past two weeks, higher energy prices were the dog that didn’t bark, Semafor’s Tim McDonnell writes.  One key reason: The conflict seems to have been resolved relatively quickly, with a fragile ceasefire holding Tuesday. But other factors — record US drilling, Iran’s overwhelming reliance on China as an oil customer, and a world already swimming in black gold — underscore how the “drill, baby, drill” mentality of both Trump and Joe Biden granted the US a geopolitical insurance policy, and how the global clean energy transition leaves exporters like Iran with fewer leverage points. |

|

Wall Street’s econ bears back off |

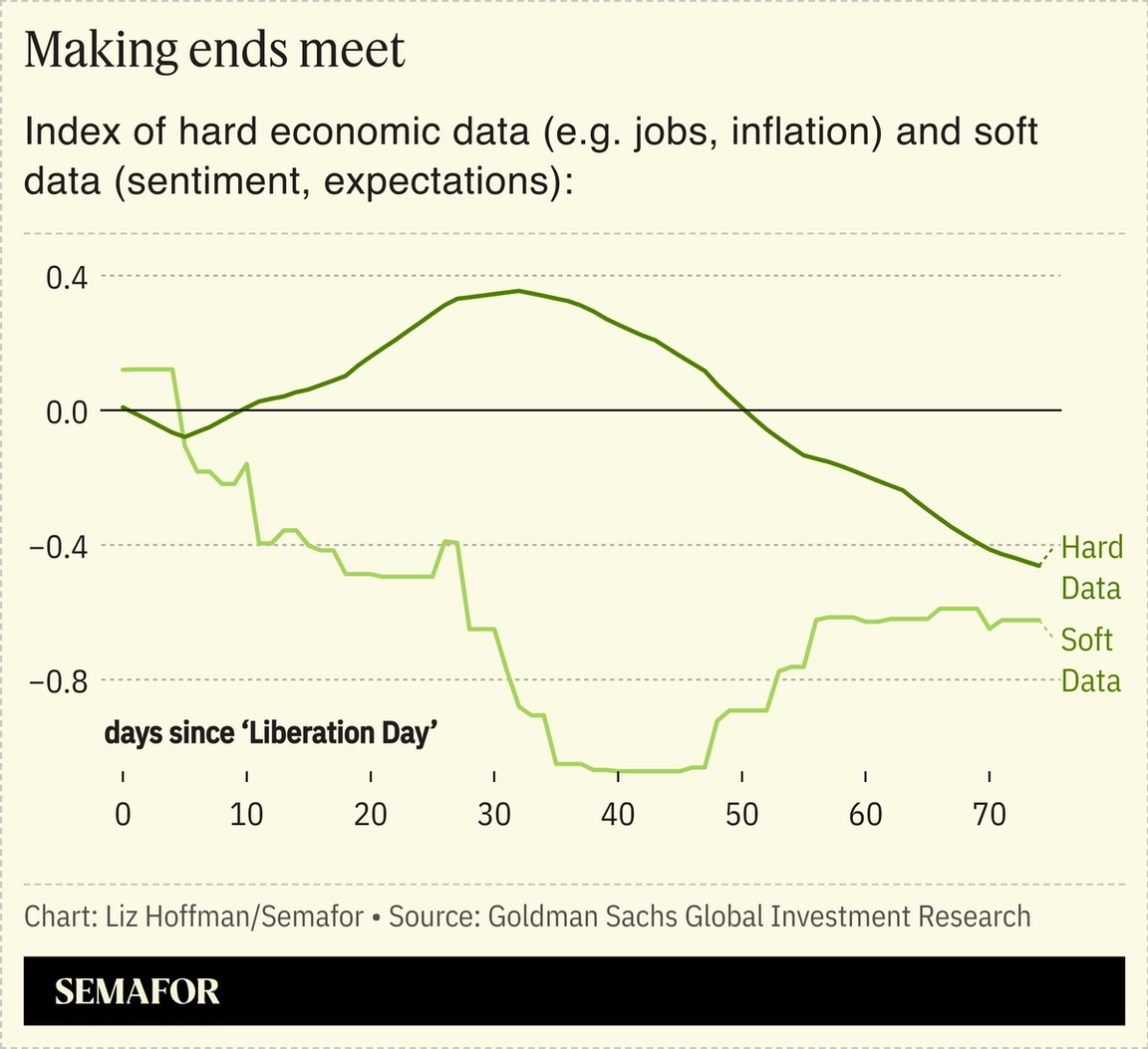

Wall Street economists are walking back their most drastic predictions for tariffs’ hit to the US economy.  “Has Trump outsmarted everyone on tariffs?” Apollo’s chief economist asked this weekend, speculating that the 90-day pause on tariffs could turn into a one-year moratorium that pushes other countries to reduce their own trade barriers and domestic subsidies. “This would seem like a victory for the world and yet would produce $400 billion of annual revenue for US taxpayers,” he writes. Goldman Sachs, meanwhile, raised its estimates for US economic growth and reduced its odds of a recession, though it warned that hard data is catching up with gloomy sentiment and declared it “too early to sound the all-clear on tariff-driven price hikes.” |

|

NYC mayoral race panics business elite |

Vincent Alban/Pool via Reuters Vincent Alban/Pool via ReutersNew York’s Democratic mayoral primary today has the city’s capital class spooked, as a 33-year-old socialist has caught former Gov. Andrew Cuomo in the polls. Zohran Mamdani’s promises to raise corporate taxes and income taxes on millionaires and freeze rents raises the specter of a leftward shift for America’s biggest city, whose already strapped finances have Wall Street worried. Mamdani’s 14-mile walk this week of Manhattan, in scorching heat, evoked the neighborhood canvasses of John Lindsay, the liberal crusader whose budget priorities contributed to the city’s 1970s fiscal crisis. The faraway conflict in Israel is another flashpoint: Mamdani in a podcast interview declined to condemn the phrase “globalize the intifada,” while Cuomo’s pro-Israel stance has won him support from financiers like Dan Loeb and Bill Ackman, who donated $250,000 to a Cuomo political action committee. Some wealthy New Yorkers are (off the record, of course) saying they’ll leave if Mamdani wins. Big checks have come from the city’s corporate elders, including lawyers from Sullivan & Cromwell, which has represented President Donald Trump, and Paul Weiss, historically a Democratic powerhouse. Financier Glenn Dubin, Two Sigma’s Scott Hoffman, former HBO chief Richard Plepler, RXR’s Scott Rechler, and real estate investor William Zeckendorf are among those who have maxed out contributions to Cuomo. Mamdani slightly lags Cuomo in the first round of ranked-choice voting, but polls show him eking out a victory once all votes are reallocated in later rounds. (CNN has a good explainer for non-New Yorkers on how ranked-choice voting works.) Room for disagreement: Mamdani might not be the progressive savior his supporters hope or the boogeyman Wall Street fears. Waleed Shahid, a progressive New York strategist, drew a comparison to Fiorello La Guardia, who ran against the political machine bosses and was endorsed by the city’s socialists but ushered in a wave of prosperity and helped build modern New York: “First they call you radical,” he writes today in The Ink. “Then they name an airport after you.” |

|

Could a post-nuclear Iran beckon Wall Street? |

Sebastian Widmann/Getty Images Sebastian Widmann/Getty Images“If we do get to a serious ceasefire, which I think is not impossible at this time, what is the big investment opportunity in the Middle East? It could be Iran.” Admiral James Stavridis, the former Supreme Allied Commander of NATO, told Semafor he sees a “two-in-three” chance of a substantive end to hostilities in which Iran’s abandonment of its nuclear program could usher in an economic reopening of the country. “There’s a lot of chaotic movement,” he said, noting that sanctions would be slow in changing. “But if you follow the geopolitical trends to a happy ending, which is not impossible, Iran becomes a very interesting investment opportunity. It could look like the reconstruction of the Korean peninsula after the end of the Korean War.” |

|

Stablecoins are not the future |

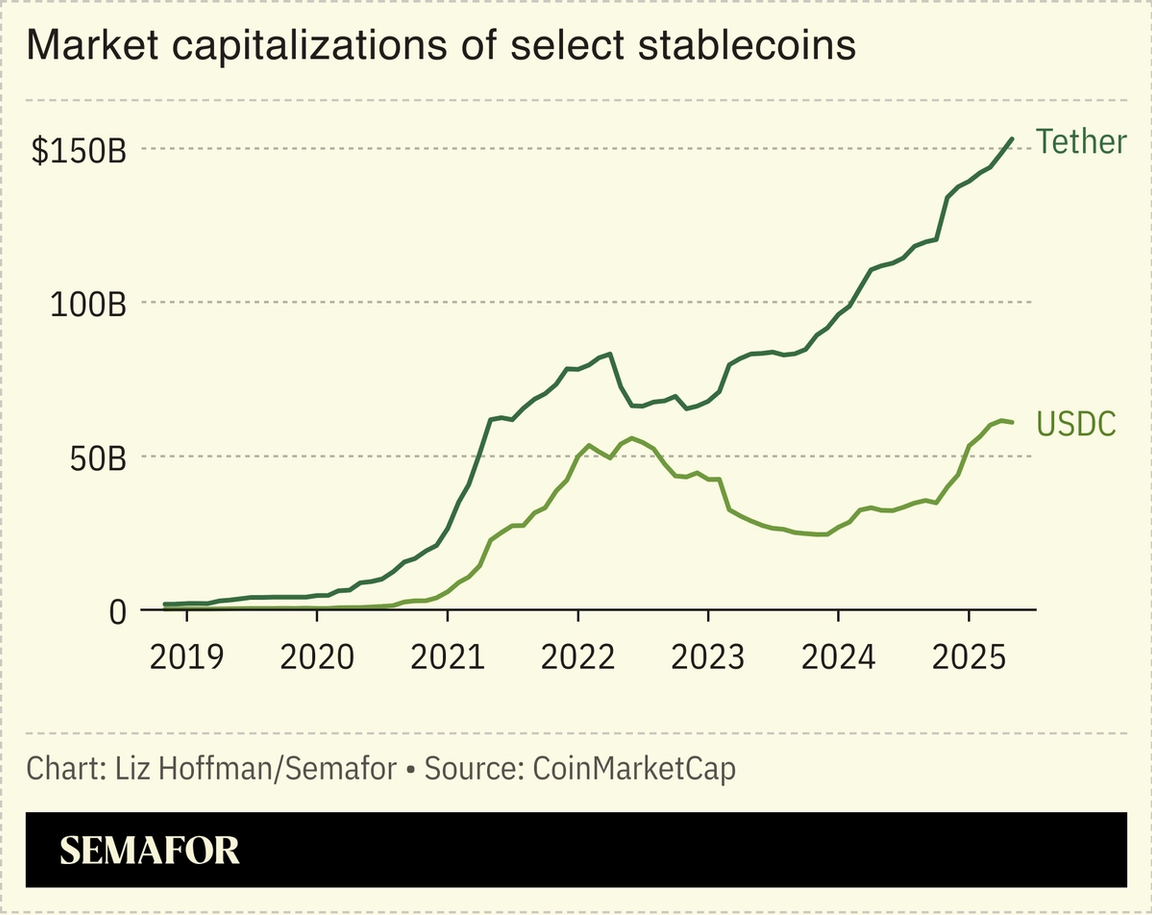

Stablecoins — digital tokens whose value is pegged to official currencies like the dollar and euro — aren’t the future of money, a powerful group of global officials said. The Bank for International Settlements, a Switzerland-based clearing house known as the “central bank for central banks,” said in a report today that stablecoins like Tether and the Circle-backed USDC fail the three main tests of money: they are vulnerable to criminal use, aren’t backed by a central authority, and can’t easily be turned into loans — the key purpose of money in generating economic growth. They are “unable to fulfill the no-questions-asked principle of bank-issued money,” BIS wrote. Central banks are naturally suspicious of challenges to their power, which DeFi memelords were quick to point out. But the indictment comes at a moment of promise for stablecoins and could set back their broader adoption, especially as the biggest stablecoin issuers try to go mainstream. Elsewhere in stablecoins: Payments giant Fiserv joined the party this morning. |

|

Read the research that is followed by the world’s top asset managers, central bankers, government officials, and academics around the world. At The Overshoot, Matthew C. Klein unpacks the details and provides unrivaled big picture analyses of the economic and financial forces that matter. Individual and institutional subscriptions are both available for purchase here. |

|

➚ BUY: Vibe coding. Copilot challenger Cursor hit $100 million in recurring revenue faster than any startup in history and is rapidly eating at Microsoft’s market share, Ramp spending data shows. ➘ SELL: Vibes, coding. Consumer sentiment unexpectedly soured this month, according to the Conference Board, muddying the waters after a more bullish turn on the University of Michigan data. |

|

Companies & Deals- Straight-Talk Express: Fred Smith, founder of FedEx and an unapologetic supporter of unfettered free trade, died Sunday. He criticized Trump’s first-term protectionist policies, telling an interviewer in 2018 that a zero-tariff, zero-subsidy world was “the proven formula for success” and calling out the president by name a year later. The CEO of a global shipping company supporting global commerce isn’t a surprise, but Smith may end up being the last big company CEO willing to unrepentantly back free trade — or criticize Trump.

- Compounding interest: BlackRock’s Larry Fink came out in support of Trump’s MAGA accounts for babies — in line with his broader push to increase retirement savings while also growing BlackRock’s AUM.

Watchdogs- Buy now, pay later, watch now: The leading credit-score company will start including popular buy-now-pay-later arrangements in consumers’ debt snapshots. A test-case study between FICO and Affirm found that most borrowers would see either no changes or a slight improvement when these loans were captured.

- The bank of Infiniti: Nissan became the latest carmaker to apply for a banking license, reopening debate about whether nontraditional companies should be in the lending business. Nissan is following Ford, GM, and Jeep maker Stellantis in launching an industrial loan company, an entity that can take federally insured deposits and make loans but that is subject to lighter scrutiny than full-scale consumer banks. The failure of GM’s lending arm in 2008, and the near-failure of General Electric’s, ushered in a moratorium on new licenses that stymied efforts by Walmart and Home Depot to get into the lending game. Carmakers are trying again with the Trump administration.

- Pay it forward: Populist British politician Nigel Farage proposed letting wealthy individuals pay £250,000 upfront to avoid taxes for life. Non-citizen billionaires including steel magnate Lakshmi Mittal have said they would leave the UK after the Labour government scrapped tax perks, leading to fears of a wealth drain.

|

|

|