| | In today’s edition: China wants a trade deal, fund managers are tepid on Saudi stocks, and a Bollywo͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- China urges GCC trade pact

- ACWA Power’s China push

- IPOs losing luster

- Oil surplus eases

- Bollywood film barred

Kabuki theater in Diriyah. |

|

China calls for deeper Gulf ties |

Saudi Crown Prince Mohammed bin Salman and Chinese Foreign Minister Wang Yi. China’s Foreign Ministry. Saudi Crown Prince Mohammed bin Salman and Chinese Foreign Minister Wang Yi. China’s Foreign Ministry.China’s foreign minister urged Gulf countries to finally seal a free trade agreement that has been in negotiations for decades. Wang Yi used a trip to Jordan, Saudi Arabia, and the UAE this week to lobby the Gulf Cooperation Council (GCC) to conclude the talks as a “strong signal defending multilateralism.” China is keen to deepen economic, trade, and investment ties with the GCC, Wang said. The GCC is negotiating several other trade deals, including ones with the EU and the UK, but a deal with China presents some thorny issues: There is a huge trade surplus in the GCC’s favor, and regional heavyweights Saudi Arabia and the UAE are both developing manufacturing bases that will increasingly pit their domestic industries against Chinese competitors. Beijing and Riyadh in particular agreed during Wang’s trip to strengthen coordination on regional and international security issues and to deepen cooperation in oil and gas, new energy, and artificial intelligence. The Chinese official’s visit comes a month after Saudi Crown Prince Mohammed bin Salman met with US President Donald Trump in Washington, in a sign of how the kingdom is increasingly positioning itself as an ally of both countries, even as China-US relations become increasingly adversarial. — Matthew Martin |

|

Yuan Hongyan/Reuters Yuan Hongyan/ReutersSaudi Arabia is stepping up its renewables push at home and abroad — with a particular focus on China. ACWA Power, the giant energy developer backed by the kingdom’s sovereign wealth fund, plans to deploy $20 billion annually over the next five years, 60% of that domestically, CEO Marco Arcelli told Semafor. The company is eyeing China as its “next big hub,” with 300 megawatts already in operation, several gigawatts awaiting approval, and $30 billion in planned investment by 2030. China’s regulatory environment — with mandated offtake and capital subsidies for green hydrogen — gives the country an edge over Europe, Japan, and South Korea, according to Arcelli. Hydrogen in particular is central to ACWA’s plans. Its $8.4 billion NEOM Green Hydrogen Project is nearing completion, with production expected to ramp up in 2027. A second, larger plant is in development in Yanbu. While demand remains uncertain, Arcelli argued green hydrogen offers long-term price stability and a strategic hedge against fossil fuel volatility. |

|

Fund managers pause Saudi investments |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersInternational fund managers have taken a pause on allocating new money to Saudi Arabia, amid a weaker stock market and concerns about earnings growth next year. While fund ownership of Saudi stocks hit a record high in 2025, growth has tapered in recent months, according to Copley Fund Research. The UAE attracted $2.2 billion in net fund inflows in the year to the end of November, compared to $679 million for Saudi Arabia, Copley data showed. The kingdom missed out on a rally in emerging market stocks this year and analysts expect a similarly moribund performance in 2026. That’s having a knock-on effect on new companies coming to the market, with the wave of IPOs in Saudi Arabia seeming to lose momentum, even as the stock exchange insists it has a “vibrant” pipeline of companies preparing to list next year. Saudi Arabia’s IPO boom had been one of the successes of the country’s efforts to open up to foreigners after decades of largely shutting out international capital. More recently though, government plans to trim spending, a review of Public Investment Fund projects, and flip-flops on measures to attract global investors have cooled enthusiasm. — Matthew Martin |

|

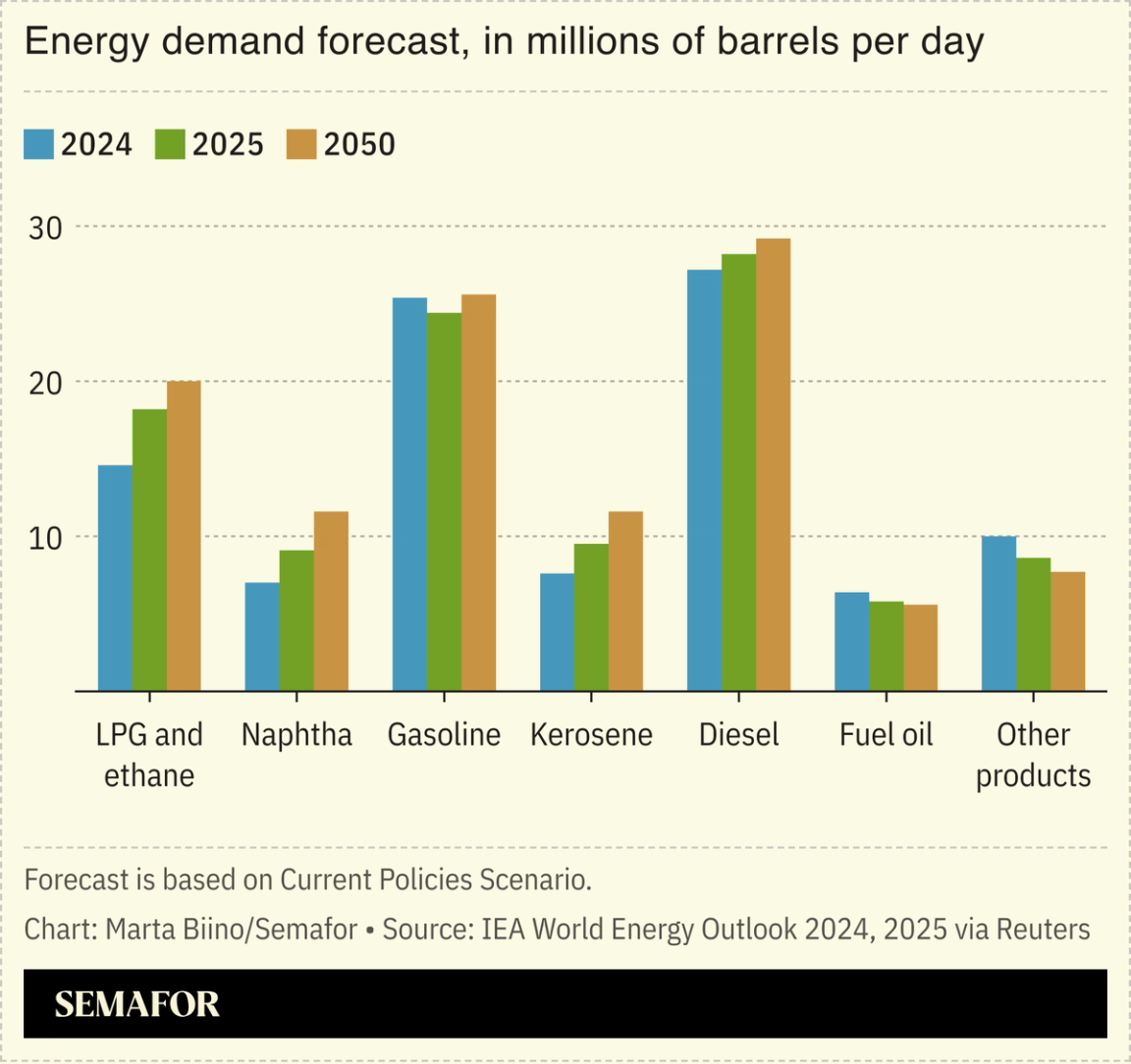

Global oil surplus could ease back |

The International Energy Agency (IEA) has raised its prediction for global oil demand growth in the year ahead, offering limited hope for Gulf producers dealing with weak prices. In its latest monthly report, the Paris-based agency predicted global supply would exceed demand by 3.8 million barrels per day (b/d) next year, down from its previous prediction of 4.1 million b/d. The agency pointed to an improving macroeconomic and trade outlook for the changing picture, as well as reduced crude flows from sanctions-hit Russia and Venezuela. In its latest monthly report, OPEC continued to predict stronger growth in demand than the IEA. Kuwait’s Oil Minister Tareq Al-Roumi has called a recent slide to around $61 a barrel unexpected, while saying prices in a range of $60 to $68 per barrel were fair. |

|

Gulf bars Bollywood thriller |

Actor Ranveer Singh and his wife actor Deepika Padukone in 2023. Niharika Kulkarni/Reuters. Actor Ranveer Singh and his wife actor Deepika Padukone in 2023. Niharika Kulkarni/Reuters.A Bollywood blockbuster will reportedly not be released in the Gulf, a lucrative market for the Indian film industry. Dhurandhar, which follows an Indian spy who infiltrates Pakistan’s underworld to dismantle terror networks, was not cleared for release, The National reported. While no reason was given, Indian media outlets reported that Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE had all banned it over worries that it could be perceived as anti-Pakistani. The movie, released months after India and Pakistan engaged in a brief armed conflict, has created a firestorm on the subcontinent, with movie critics facing online attacks over reviews. One Gulf local is benefiting from the tensions between the South Asian powers, though: Bahraini rapper Flipperachi has become a sensation in India, thanks to his track Fa9la featuring in a key scene in the film. — Tasneem Nashrulla |

|

Diplomacy- India’s Prime Minister Narendra Modi is due to call in to Oman as part of a three-country tour that first takes in Jordan and Ethiopia, starting on Dec. 15.

Energy- Four Saudi companies reached agreements with the government-owned Syrian Petroleum Co. to help develop oil and gas fields in Syria. The companies — TAQA, ADES Holding Co., Arabian Drilling Co., and Arabian Geophysical & Surveying Co. — aim to improve efficiency and boost production from existing fields. — Arab News

Finance- DIFC, Dubai’s financial district, now hosts more than 100 hedge funds, double the number at the start of last year, though still far behind established hubs such as New York and Hong Kong. — Bloomberg

Health care- The health care unit of Abu Dhabi AI conglomerate G42 is expanding in the Gulf with a new facility in Manama. Through a partnership with Bahrain’s sovereign wealth fund Mumtalakat, M42 will open Amana Healthcare Bahrain, a first-of-its-kind hospital in the country for long-term rehabilitation.

Infrastructure- Kuwait’s government plans to sign a contract for the giant Mubarak Al-Kabeer Port project with an affiliate of China’s Ministry of Transport later this month — part of a wide-ranging bilateral economic relationship championed by Emir Sheikh Mishal Al-Sabah.

Manufacturing- Dubai-based Legend Holding Group announced a 500-million-dirham ($136-million) expansion of its Jebel Ali Free Zone site, including a new regional headquarters and an assembly line producing up to 10,000 motorbikes a year.

|

|

A Kabuki play being performed in London. Kieran Doherty/Reuters. A Kabuki play being performed in London. Kieran Doherty/Reuters.Japan’s cultural exports tend to be led by its pop bands and anime and manga cartoons. But another heavily stylized entertainment form was recently being promoted in Saudi Arabia: The traditional theater of Kabuki. Around 3,000 people watched across six performances in Riyadh and Jeddah. On the outskirts of the capital, the actor Hayato Nakamura danced against the backdrop of Diriyah’s ancient stone walls; in Jeddah he performed in an immersive digital show created with Tokyo-based artist collective teamLab. In a break from the tradition back home, Nakamura applied his own white, red, and black kumadori makeup on stage at the start of his performance. Kabuki was badly hit by the COVID-19 pandemic — when its often elderly local audience steered clear of the theater — but the art form is now making a comeback abroad as well as at home. |

|

| |  | | | You’re receiving this email because you signed up for briefings from Semafor. |

|