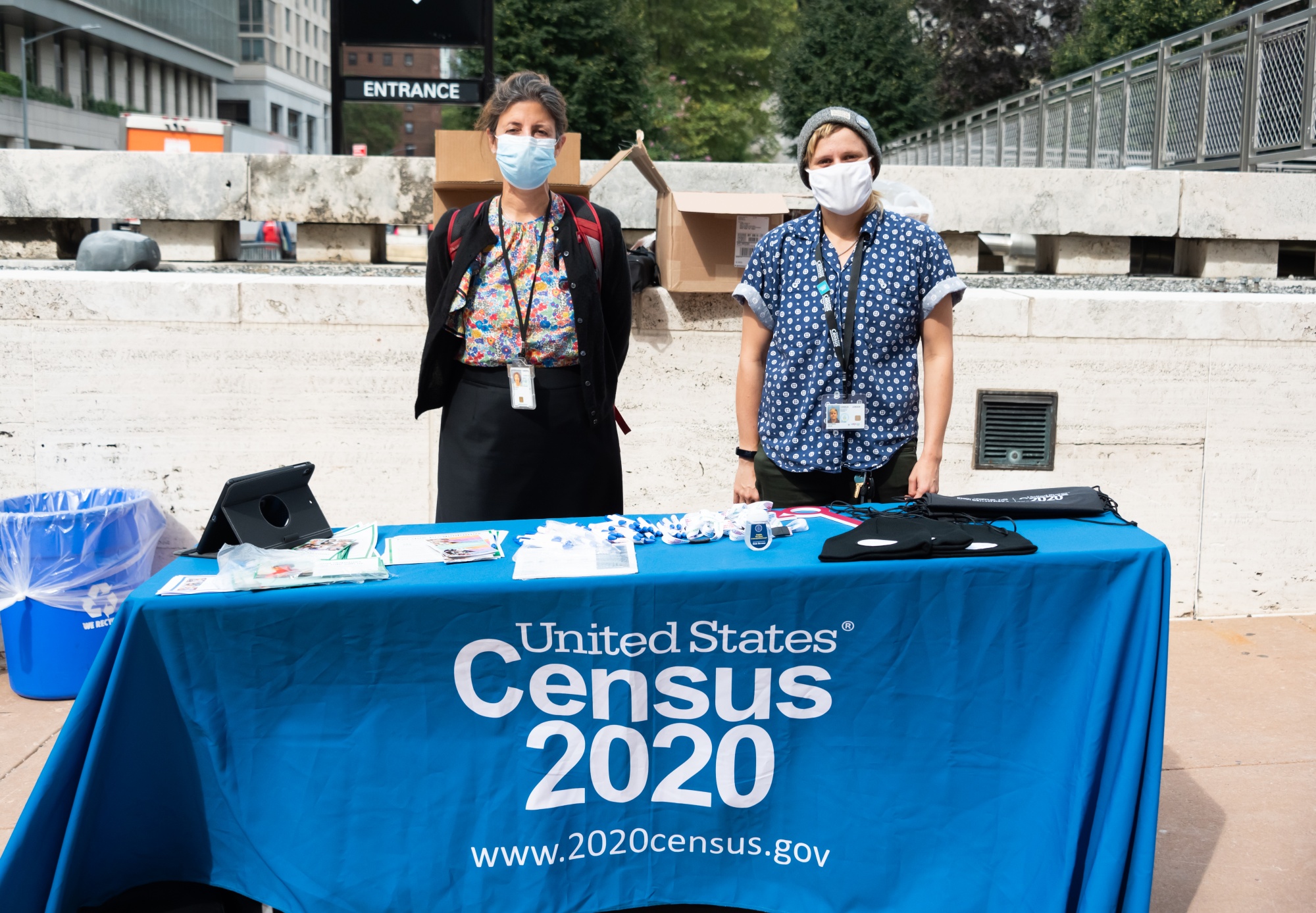

| Donald Trump looks like he wants to put his stamp on some of America’s most important numbers. The president told his Commerce Department to start work on “a new and highly accurate CENSUS based on modern day facts and figures” — one he said would exclude undocumented migrants from the count, and draw on last year’s presidential election results. It’s the second time in a week that Trump has tangled with the most important US data-collecting agencies. Last Friday, after a weak jobs report, he fired the head of the agency that published it — the Bureau of Labor Statistics — alleging political bias without providingevidence. Trump’s assault on federal scorekeepers has also extended to the Congressional Budget Office (which has given unflattering estimates of his tax bill’s impact on budget deficits) and the Government Accountability Office (which has declared many of Trump’s funding freezes illegal). Those offices report to Congress, not the president, so all he can do is complain when they produce reports he doesn’t like. But both of Trump’s latest interventions into official number-crunching, which is typically carried out by nonpartisan technicians, have the potential to cause turmoil. In the case of the census, the upheaval could be political. The headcount is used to determine each state’s representation in Congress, as well as federal funding for local communities. Excluding undocumented migrants — which Trump tried to do in his first term, before courts blocked him — might reduce the clout of Democratic strongholds in California and New York, though it would also hit GOP-voting Texas and Florida. The US conducts a census every decade, with the last one carried out in the pandemic-disrupted year of 2020.  Census workers in New York during the Covid-disrupted 2020 count. Photographer: Noam Galai/Getty Images North America Trump didn’t say whether he wants to truncate this timetable or is merely laying the groundwork for the 2030 count. Nor is it clear how election results are supposed to factor in. Meanwhile, the president is weighing who to put in charge at the BLS. Investors shift billions of dollars around world markets based on the agency’s data, so any suspicion it could be massaged for political ends is potentially dangerous. Trump’s longtime adviser Steve Bannon, still influential in conservative circles, likely didn’t help allay such concerns when he called for a “MAGA Republican” to get the job. |