|

||

| Axios Markets | ||

| By Madison Mills · Aug 08, 2025 | ||

|

We have a new Fed governor! President Trump will nominate his chair of the Council of Economic Advisors, Stephen Miran, to the Federal Reserve board of governors on a short-term basis. Interest-rate doves texted me to celebrate.

Let's get into it. All in 1,200 words and 4 minutes. |

||

| 1 big thing: Private credit is coming to your 401(k) | ||

| By Madison Mills | ||

|

||

|

Illustration: Sarah Grillo/Axios |

||

|

President Trump signed an executive order instructing the Department of Labor to reevaluate guidance for employers on incorporating assets like private credit, real estate and crypto into retirement plans. Why it matters: Private credit is golden child of Wall Street, promising diversification and potentially enormous returns compared to the stock market. But the catch is in the name: private.

Catch up quick: Private credit lets investors gain exposure to private companies by lending them money instead of buying their stock.

Driving the news: Ahead of the executive order, retirement service providers have increasingly been jumping into the private credit pool, with Empower and Wellington pursuing expansion plans.

What they're saying: "Don't get distracted by shiny objects…there's a reason why this is only for the affluent," Victoria Ferguson, certified financial planner and wealth advisor at Mercer Advisors, tells Axios. She cautions investors to not get caught up in the idea that this is a secret tool of the wealthy.

Yes, but: Around 87% of US companies that have over $100 million in revenue were privately owned as of 2023, according to a Partners Group report.

Zoom out: OpenAI just had a $500 billion valuation tied to its employee stock sale this week. This is an example of why more novice investors want access to private companies: Companies are staying private for longer, and active retail investors want a chance to get in on the action. By the numbers: According to data from Empower, one of the firms that provides access to private credit assets, consumers are eager to invest.

The bottom line: If you want riskier investment strategies with potentially juicier returns, "your 401(k) is probably not the best place for that," Ferguson says. "You don't want to put your biggest financial goal you will ever achieve at risk." |

||

|

|

||

| 2. How the wealth gap may hurt the labor market | ||

| By Madison Mills | ||

|

||

|

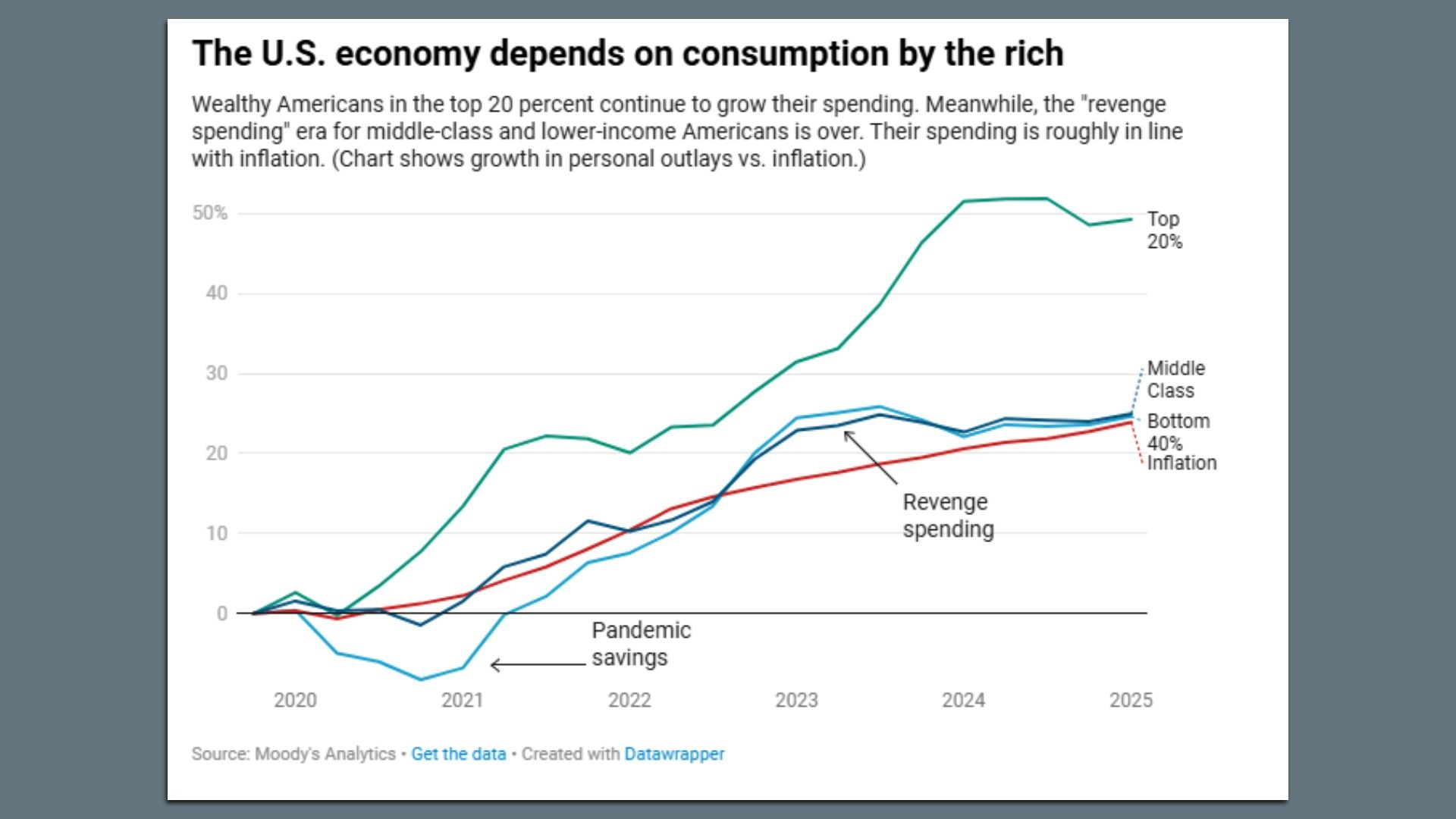

Chart: Moody's Analytics |

||

|

Spending is being held up by the wealthy, while consumption from middle and lower-income groups continues to fade. Why it matters: The tale of two economies, called a K-shaped recovery, is taking shape before tariffs have even taken effect, which could further pressure lower-income spenders and potentially the labor market. Catch up quick: The top 20% of earners now make up more than half of consumer spending, according to data from Moody's.

What they're saying: "The lower-income households are struggling, and you also see that on the corporate side, so those who serve that segment don't have pricing power," Mohamed El-Erian, former PIMCO CEO and current president of Queen's College at Cambridge University, tells Axios. Be smart: It's not just wealthy consumers faring better. Bigger businesses are also outperforming.

Zoom in: Lower-income households are more exposed to tariffs not just from an employment perspective. They also spend more on affected goods. The intrigue: Americans with less money are also less likely to benefit from the wealth effect, which is the rally in stock prices that fuels spending among those who own stocks (people who tend to already be wealthy).

The bottom line: A handful of wealthy Americans and large corporations are seemingly keeping the economy afloat while the majority of the population is struggling to keep pace with inflation, all before tariffs are fully baked in. |

||

|

|

||

|

A message from Axios |

||

| Go deeper with Axios Communicators Pro | ||

|

||

|

Axios Communicators Pro Membership gives comms professionals the expert insights, actionable data and industry connections needed to navigate the evolving communications landscape. Join now to unlock exclusive benefits to help you tackle the industry's demands. |

||

| 3. Vanguard bulls up on bonds as rally continues | ||

| By Madison Mills | ||

|

||

|

Illustration: Megan Robinson/Axios |

||

|

Amid calls of a bubble, Vanguard is increasing allocation to a safer corner of the market for one of its portfolios: bonds, with fixed income accounting for 70% of its holdings. Why it matters: The increase in bond allocation comes with a warning: Stocks aren't getting enough reward for the risk of holding stocks. Situational awareness: Vanguard's time-varying asset allocation portfolio (TVAA) is now skewed more conservative than its benchmark portfolio.

Be smart: TVAA is readjusted frequently, optimized for "higher expected risk-adjusted returns over the next decade," according to a note from Vanguard. Zoom in: Within the 30% allocation to stocks, the portfolio also leans risk-off.

The bottom line: This portfolio from Vanguard sends a clear message: The juice within stocks may not be worth the squeeze as a record rally has made this equity market expensive. |

||

|

|

||

|

A MESSAGE FROM AXIOS |

||

| Go deeper with Axios Communicators Pro | ||

|

||

|

Axios Communicators Pro Membership gives comms professionals the expert insights, actionable data and industry connections needed to navigate the evolving communications landscape. Join now to unlock exclusive benefits to help you tackle the industry's demands. |

||

|

|