gene editing

Tune Therapeutics cuts staff despite promising results

From my colleague Allison DeAngelis: Eight months after announcing it raised $175 million in new funding, gene-editing startup Tune Therapeutics has laid off a quarter of its staff.

Spokesperson Emily Steinhauer said the decision to cut 17 employees came after a review of the startup’s plans initiated by CEO John McHutchison, who the reins at the company in March.

Tune was founded in 2021 and has grabbed industry attention with the early results of its gene-editing work. It's using a defanged form of CRISPR called epigenetic editing, which doesn’t cut DNA strands; instead, it alters the layers of chemical coding sitting on top of it. In early tests, this approach was able to lower heart-disease-causing LDL, or “bad” cholesterol, by more than 50%. The company has reported that the genetic edits have proven durable, lasting over two years.

Even still, the gene-editing field has been chilled by a long financing winter, during which several companies have laid off staff or even shut down. Steinhauer told STAT that Tune’s R&D work isn’t being impacted by the staff cuts. The biotech is currently running its first clinical trial of a therapy to treat chronic hepatitis B. That work is ongoing.

BIOTECH

Eli Lilly's very bad day

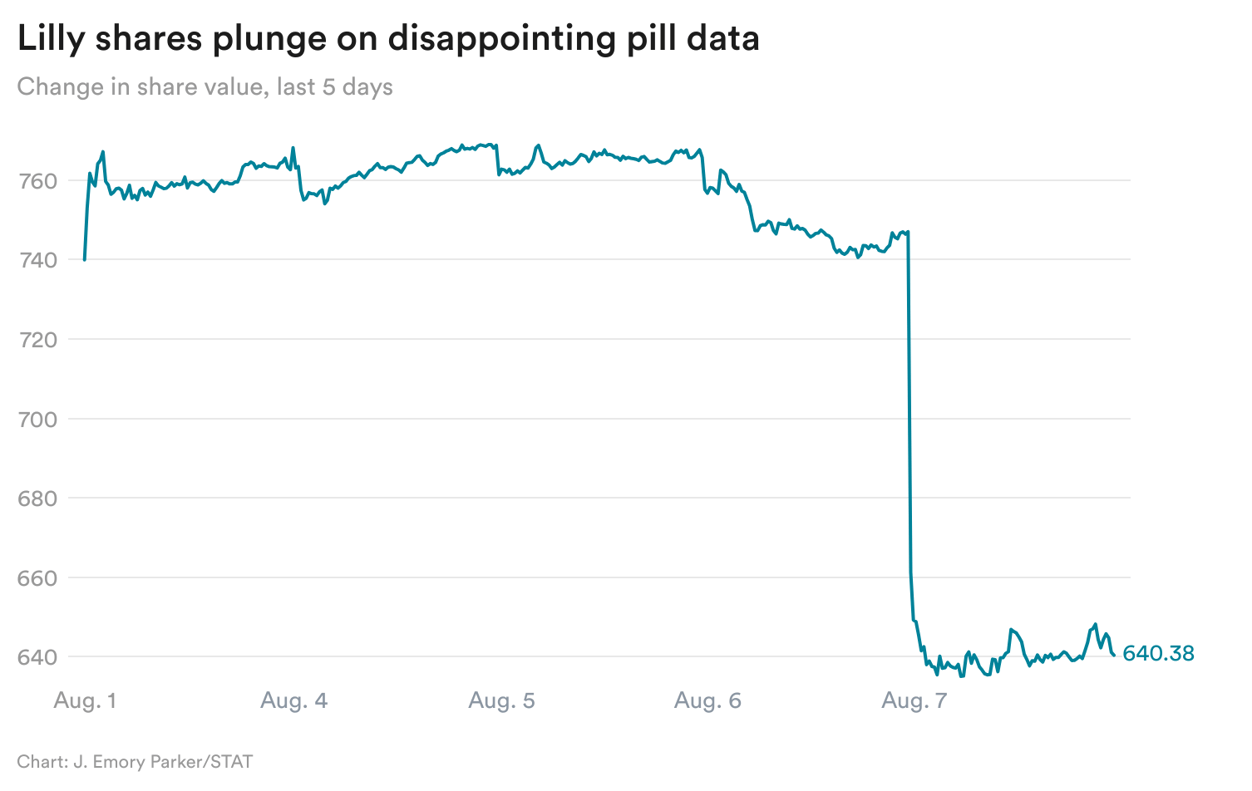

From my colleague Elaine Chen: Shares of Eli Lilly plummeted 14% yesterday after the company reported that its obesity pill, orforglipron, led to 11% weight loss in a pivotal trial, efficacy that fell short of what we’ve seen with current injectables on the market.

It’s not just efficacy that mattered, but also tolerability. Rates of nausea and vomiting with the small molecule were similar to what’s seen with currently available drugs, but it’s not yet clear what the gastro-intestinal side effects would look like in the real world. If patients in real life are not closely adhering to the titration schedule or consistently taking the pill everyday, then they would have more dramatic fluctuations of drug substance in their body, and presumably may experience even more frequent side effects, said Leerink analyst David Risinger, who lowered his price target for Lilly yesterday, in part due to the orforglipron results.

Michael Weintraub, an endocrinologist at NYU Langone, said that he currently would opt for prescribing the injectables over orforglipron, not only because the injectables have greater efficacy, but also because they have much more data backing their benefits for other conditions like heart disease.

Does this spell the end for orforglipron then? The experts I spoke with think there will still be strong demand for the treatment. Some patients would much prefer the convenience of pills, especially if they travel frequently and can’t easily bring along the injectables, which have to stay refrigerated, Werintraub said.

Also, the low cost of manufacturing small molecules (relative to injectables) would allow Lilly to sell it in places around the world where injectables currently aren’t offered.

Though he lowered his price target, Risinger still predicts orforglipron will bring in $14 billion in sales in 2030. But of course, other companies developing small molecule candidates — like AstraZeneca, Structure Therapeutics, and Terns Pharmaceuticals — could change that outlook as they report their own data.