| Read in browser | |||||||

Welcome to the Business of Sports newsletter. This week we introduce our occasional Locker Room section. Think of it as a reporter’s notebook meets gossip column where we’ll inform (hopefully) and sometimes ask our readers for help. We also look at the mess at the NFLPA, and given that it’s summer, we go sailing. As always, send us any feedback, tips or ideas here. If you aren’t yet signed up to receive this newsletter, you can do so here. Locker Room

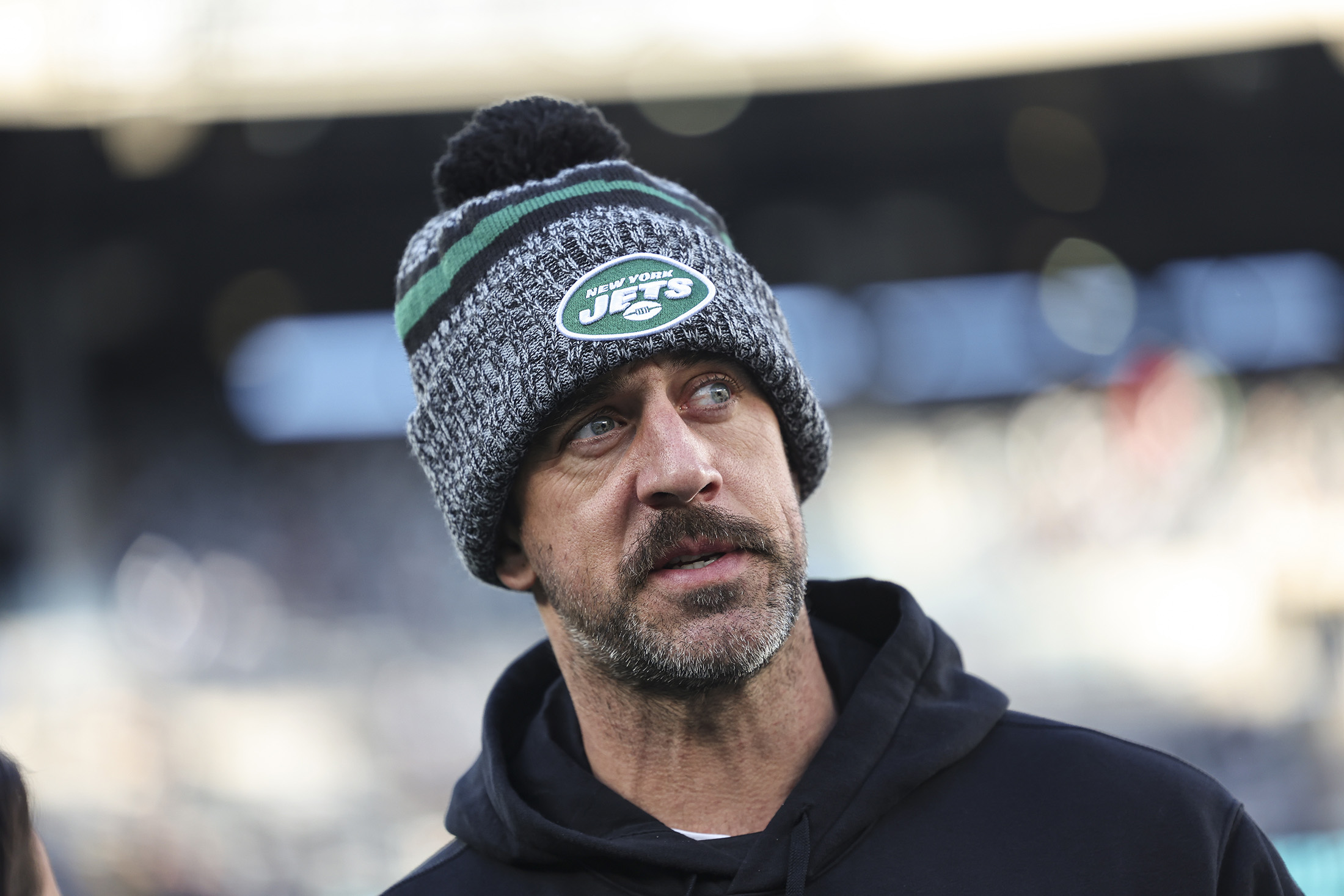

NFLPA’s Secret VC FundWhat’s up folks, it’s Randall here. I hope all of you are having a much better summer than the National Football League Players Association. In case you missed it, the feds are investigating the union and both the top boss (Lloyd Howell Jr.) and his second in command (JC Tretter) resigned following reports from Pablo Torre and ESPN. The union has now brought on David White, the former executive director of the Screen Actors Guild, to stabilize an organization that has been shaken like a snow globe. One of the casualties from Howell’s departure is the union’s secret venture fund project. Howell hoped one day it would raise enough funds to invest in an NFL franchise. The NFLPA declined to comment. Howell didn’t respond to a request for comment. It sounds like a wild idea but let me explain what multiple people have told me. Unbeknownst to players, Howell was already serving as an operations executive for private equity firm Carlyle Group’s aerospace and defense team when he joined the NFLPA as executive director in June 2023. (Once hired at the union, he transitioned to a part-time consulting job at Carlyle.)  Aaron Rodgers tried to negotiate a contract in 2023 that included an ownership stake in the New York Jets. Photographer: Perry Knotts/Getty Images Getty Images North America NFL owners have long considered allowing private equity to invest in the league, and talks picked up in September 2023. Howell was privy to the conversations the league was having with firms, according to people familiar with the matter. He made that known in his opening press conference in Las Vegas in February 2024. “In my discussions with the league, they have some very reputable firms in the mix,” he said. The league approved private equity in August last year. Carlyle is part of one of the groups that’ve been granted the green light to invest in teams. Howell wanted in on the action, with the idea of raising money to create a union fund and one day gaining approval to invest in not only NFL teams but other sports franchises. Pro athletes are increasingly interested in attaining team equity. For example, Aaron Rodgers reportedly pushed for an ownership stake in the Jets in 2023 during contract negotiations. The NFL later banned such a deal. Let’s just say that if they raised enough money to do what Howell intended, it’s hard for me to imagine NFL owners approving a union fund. However, it’s also possible Howell had conversations with NFL owners that led him to believe this would’ve been a viable option. Now, we’ll never know. The fund may not ever get picked up again because new interim executive director David White has much bigger fish to fry, most importantly galvanizing NFL players. Fortunately for White, time is on his side. The NFL’s collective bargaining agreement doesn’t expire until 2031, so there’s no immediate conflict unless an unforeseen event occurs. However, an 18th game for the NFL is on the horizon. Howell initially supported this idea but shifted his stance during Super Bowl week, stating that players are against it. But how a players’ vote would go remains to be seen. Younger players I’ve spoken with don’t seem to object, provided they receive increased compensation and an additional bye week. Veterans, on the other hand, have expressed concerns about the physical toll of adding a game. It’s unclear where White stands on an 18th game but I’d expect him to push back against it. Anyways, that’s my tidbit on the ongoing drama with the NFLPA, but I imagine there will be much more news to come. Stay tuned! ICYMI

Making Sailing CoolHi. It’s Siobhan Wagner. Russell Coutts is selling a very different vision for sailing. The five-time America’s Cup winner is chief executive officer of SailGP, a league he started in 2018 with Oracle cofounder Larry Ellison, the world’s second richest person, to make sailing more fun. Teams compete in high-performance catamarans that exceed 60 miles per hour and zoom close to grandstands of fans that overlook the water.  Sir Russell Coutts, SailGP’s CEO, has big plans for the league. Source: SailGP Investors are piling into the league, which has teams representing 12 countries. Ares Management took a minority stake in France’s team in June, joining other investors including French footballer Kylian Mbappé. Hollywood actors Anne Hathaway, Ryan Reynolds and Hugh Jackman have also bought into other teams. Demand is increasing, with team valuations now topping $50 million, Coutts said. That’s up as much as ten times from a few seasons ago, according to SailGP, which is working on adding two new teams. Coutts spoke with Bloomberg about how to broaden the appeal of sailing and the business opportunity SailGP presents for investors. I went to a SailGP event with a colleague who wasn’t into sailing, and she was surprised by how much fun she had. Since then, other people I’ve asked about sailing say it’s boring. How do you overcome that perception? Your experience on site is pretty much no different to the vast majority of people that come to a SailGP event. The typical reaction is: ‘Wow, I didn’t picture anything like this.’ People picture white triangles on a blue background racing far away from shore, maybe somebody holding a gin and tonic in their hand, you know? Blue blazers, wool trousers, the yacht club-style approach. And when they come and experience it, it’s very different.  A SailGP race last month in Portsmouth, England. Source: SailGP What’s the makeup of the fanbase? Most of the audience that’s watching SailGP are not avid sailors. Typically, we are getting 10-15% avid sailors, whether that be live on site or watching a broadcast. Our demographic skews younger as well, and it’s more female. We are way more balanced in terms of audience demographics than what you would imagine traditional sailing probably would be. One interesting aspect of SailGP is that it has total creative control. That’s far different than the America’s Cup, where rules are designed and agreed to by various yacht clubs. How are you taking advantage of that? The boats are identical. So that allows you to have the data in the public forum. What does that mean? It means that we’re recording the voices of the athletes during the racing, all of them, when they talk to the coach, which isn’t allowed in other forms of sailing during the race. We record that and distribute it to the fans when necessary. [It’s] similar to what you get in motor racing, where the team will advise the driver on what to do. Ultimately, I think there’ll be 360-degree cameras on the boats. Rather than watching a traditional broadcast, the avid fan will be able to go onboard the boats. We’ve already trialed this. It’s fabulous. You get the true perspective of just how extreme this racing is, how close it is, and how terrifying it is. This is a real advantage we’ve got. Because of the secrecy between teams and so forth [with other sailing entities], they don’t have that capability to really open things up in a true media sense.  A SailGP practice before an event in New York in June. Source: SailGP How do you make money? It’s a traditional sports model. The league is centrally managed on behalf of the teams. Traditional revenue streams [also include] your sponsorship. We get fees from venues. Eventually, we’ll have broadcast fees. That’s in development now. We’re also entering the world of sports betting. What’s the current financial state of the business at the moment? We are cash positive this year for the first time. So that means we don’t require funding from [co-founder Larry Ellison], and we are moving pretty fast. Obviously, valuations for teams have skyrocketed over the last few years, and we expect that to continue to grow. Right now we’re at 12 teams, and we’ve taken 13 and 14 to market. Our plan is to grow that to 20 teams. What kind of legacy would you like SailGP to have? I can’t see many sports being successful if they don’t market themselves. So if we can get more eyeballs on this. Get more people enthusiastic about it. Then you know, everyone involved in sailing is going to benefit. The marine industry will benefit as a whole. More young kids will get into it. They’ll get excited by it. That’s got to be a good thing for the sport. Whereas before SailGP came along, there was almost no visibility around the sport. (Editor’s note: This interview has been edited and condensed for clarity.) More From BloombergFor more on the intersection of money and sports, subscribe to the Bloomberg Business of Sports podcast. Find it on Apple, Spotify or anywhere you listen. Get Bloomberg newsletters in your inbox:

Explore all newsletters at Bloomberg.com. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Business of Sports newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|