| | In this edition, why Oracle’s $50 billion raise might not be enough to compete in the AI race, and t͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Musk’s megamerger

- CEO musical chairs

- Netflix’s YouTube boogeyman

- Econ data blackout (again)

- Saudi’s cash crunch

A YouTuber beat Melania … Milei wants the billions Argentines have stashed under their beds |

|

Larry Ellison brought a knife to a gun fight. Oracle’s announcement that it will raise $50 billion in debt and equity to finance its massive data center commitments has laid bare the brutal economics of the AI buildout: Some players can afford it, and some can’t. Oracle has been the bellwether for AI worries for a while now. It doesn’t have the cash-cow businesses that allowed Amazon, Alphabet, Meta, and Microsoft to pour billions into their AI dreams without (mostly) anyone batting an eye. Its basic tension is that it’s behaving like a hyperscaler while carrying the balance sheet and investor expectations of an old-school software company. Creditors haven’t exactly called its bluff, lining up in droves for Oracle’s $25 billion bond issuance yesterday. But the cost to insure its debt has skyrocketed, and some bondholders sued last month, saying the company misled them about future fundraising plans that triggered a “swift and bracing” selloff. And it has $248 billion of lease commitments that aren’t debt in the strict accounting sense, but are debt in the sense that failing to make those scheduled payments would be very, very bad. Oracle’s overwrought response to reporting that Nvidia may renege on the $100 billion it promised to OpenAI — Oracle’s biggest customer — is unnervingly phrased. Oracle said it was confident OpenAI can raise money, not make money. That distinction captures the precarious foundation of today’s AI economy, which runs on venture-capital FOMO, not paying customers. Every emerging technology depends on investors willing to carry it until revenue materializes. But AI’s price tag is unprecedented and for Oracle — without the deep pockets of its hyperscaler rivals — the game may already be too expensive to play. |

|

Nathan Howard/File Photo/Reuters Nathan Howard/File Photo/ReutersThe record-setting $1.25 trillion merger (more on that math in a minute) of SpaceX and xAI shows that for all its empire-building — cars, robots, satellites, brain implants, alt-right-infused AI-generated porn — Elon Inc. has always been about one thing: Mars. Musk has tapped Tesla and his own fortune before to pay for SpaceX, which is his first, primary, and lifelong obsession. He’s willing to bend the norms of corporate finance — and, by listing SpaceX later this year, double the burden of running a public company, something he’s long despised — to build a “Kardashev II-level civilization” and not get lapped by Jeff Bezos or anyone else in the race. The merger’s headline figures are, essentially, made up: SpaceX and xAI, and their stock, are privately valued by a shareholder base controlled by Musk and populated by his friends. A SpaceX IPO, if blessed by the planetary gods, will unfuzz that math. It will also clarify the rationale behind plugging the social network formerly known as Twitter (which xAI bought last year in another hand-wavy deal valued at $33 billion) into a satellite launcher. Speaking of X, it’s so back, Semafor’s Ben Smith writes. It’s where “you can find bots at their weirdest and sweetest” and “humans at their worst,” but is “now undoubtedly at the beating heart of news again.” |

|

CEO reshuffle at Disney, HP, and PayPal |

Josh D’Amaro and Bob Iger in 2025. Handout/Getty. Josh D’Amaro and Bob Iger in 2025. Handout/Getty.Call it Turnover Tuesday. Disney, HP, and PayPal all announced new CEOs today — for very different reasons. Disney’s board, determined not to repeat its last, blundering executive handoff, picked theme-parks chief Josh D’Amaro to replace Bob Iger. D’Amaro’s selection, over programming chief Dana Walden, cements Disney’s future in its IP-fueled and operationally intensive experiences (i.e. parks and cruises) as AI and streaming loom large over the content business. Today’s two tech-company moves are a messier story. HP CEO Enrique Lores blindsided his board when he accepted the top job at PayPal, capping a search process that he was involved in as PayPal’s board chair, Semafor’s Rohan Goswami reports. (Echoes of PayPal’s former CEO, who, as Verizon’s lead independent director, ran the search for a new CEO in October and ended up with the job himself.) HP, which tapped a board member with little tech experience as interim chief, is now rushing to find a permanent head. |

|

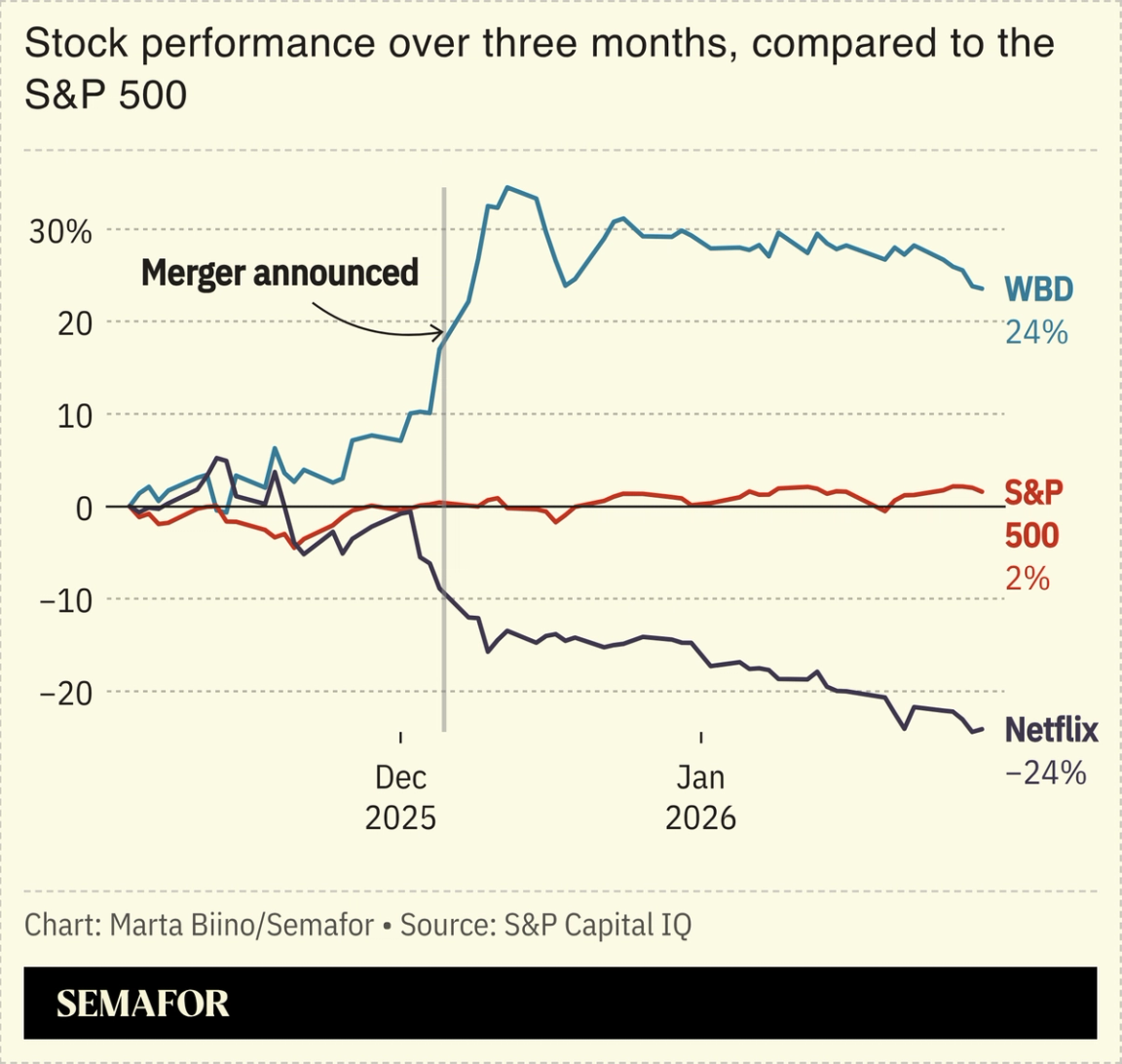

Netflix, WBD seek blessing from lawmakers |

Top Netflix and Warner Bros. Discovery executives are in Washington today to persuade lawmakers that their $83 billion merger won’t crowd out competition. Netflix co-CEO Ted Sarandos and WBD M&A executive Bruce Campbell plan to tell a Senate antitrust committee that they need to bulk up to take on YouTube and TikTok. It’s an argument that worked for Meta last year, when the government lost its case arguing that the company was an illegal monopoly. New competitors, the impact of AI, and shifting consumer habits — “everything is becoming television,” Instagram boss Adam Mosseri told Semafor’s Mixed Signals podcast recently, explaining the company’s belated push onto big screens — give some credibility to companies’ usual complaints that the government just doesn’t understand. (“I guess I will go to TikTok next time I want to watch Game of Thrones, Landman and the Sopranos,” a lawyer for Paramount, which also wants to buy WBD, wrote recently on LinkedIn.) Expect a bipartisan grilling. The Republican chair of the Senate committee, Mike Lee, has already said that even if the Netflix-WBD deal ultimately dies, the attempt would have weakened competition “through the pendency of the merger review process.” — Rohan Goswami |

|

Economic data is back in blackout |

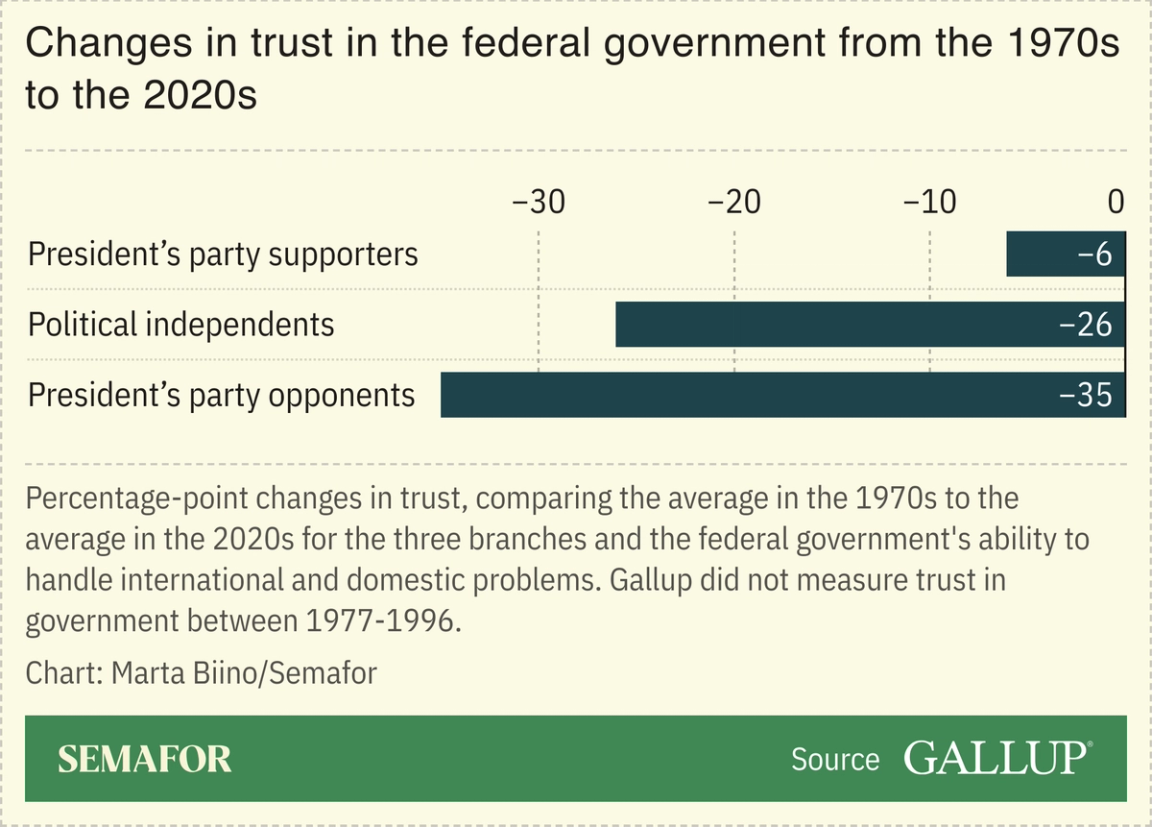

This again: Key US economic data will be delayed due to the government shutdown, leaving investors and policymakers in the dark. The Bureau of Labor Statistics won’t release January’s jobs numbers as expected this week and the agency will pause collecting February inflation data, which “has greater potential for lasting damage,” David Wilcox, an economist with the Peterson Institute for International Economics, told Semafor. That matters for the Federal Reserve, where already divided policymakers will lean on the data when they meet in March — and for the diminishing trust in government data. The inability to “release that data consistently” feeds a “growing cynicism” about the Fed, the Bipartisan Policy Center’s Emerson Sprick told Semafor. — Eleanor Mueller |

|

Saudi Arabia’s cash crunch |

Mohammed Benmansour/Reuters Mohammed Benmansour/ReutersSaudi Arabia is counting on foreign investors to fix its cash crunch. With a budget in deficit, huge spending commitments piling up, and capital-starved banks struggling to keep up with loan demand, the kingdom is stepping up its courtship of foreign investors, Semafor’s Matthew Martin writes. Outstanding Saudi debt is set to cross $600 billion this year. The country is also easing restrictions on who can buy shares in Tadawul-listed companies to grease its IPO pipeline. “The kingdom has gone through the flat part of the S curve, we have planned and we have reformed,” Saudi’s investment minister told Semafor. “Now we are climbing the vertical part.” |

|

The Hustle brings you business as unusual: daring moonshots, oddball startups, and trends from the fringes that traditional outlets miss. No recycled headlines, no ads, just fresh ideas in a fun, quick read. Ready for something different? Subscribe today. |

|

➚ BUY: NBC. The winter Olympics’ media home is betting that the first US-friendly time zone in 16 years, and a Super Bowl broadcast timed to promote it, can replicate the smash success of the 2024 Paris games. Ad inventory was sold out a month ago. ➘ SELL: Universal. A Spanish figure skater may have to change his Minions-themed routine after the International Skating Union failed to clear the music, a microcosm of the headaches that come with a global media event. A 2022 lawsuit vaulted the skating world into its copyright era. |

|

Companies & Deals- Public-private partnership: The Trump administration’s new critical minerals stockpile, aimed at reducing reliance on China, has nearly $2 billion in seed money from private companies and a $10 billion loan from the government’s Export-Import Bank.

- ICE out: French IT company Capgemini said it was selling one of its subsidiaries that works with US immigration enforcement.

- Number go up: Walmart’s market capitalization hit $1 trillion, cracking a club mostly open only to tech companies. Eli Lilly briefly hit the milestone last year in a first for Big Pharma.

Watchdogs- Björked: The executive chair of UK’s PE firm Permira, Kurt Björklund, is the latest financier to huffily leave London under the threat of higher taxes.

- Crimson tide: Trump said he is now seeking $1 billion in damages from Harvard, hours after The New York Times reported the administration was dropping its demand for cash. “This should be a Criminal, not Civil, event,” he wrote on Truth Social.

- Enfin: France finally passed a government budget, ending a debacle that outran two prime ministers, boosted support for far-right parties, and raised doubts over the country’s long-term finances — and still falls short of its deficit-shrinking goal.

Markets |

|

|